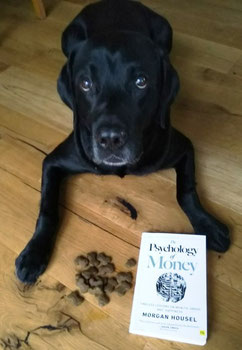

The Psychology of Money.

Timeless Lessons on Wealth, Greed, and Happiness

By Morgan Housel

Finance books are not my normal reading fare (although they probably should be), and I bought this one mainly because the word “psychology” was in the title.

The Psychology of Money is a great book and it’s easy to read. You don’t need a degree in economics or have to know anything about the stock market to understand the lessons here. But even two people I know who seem to devour every finance book on the market and who do know a lot about the subject were impressed with Housel’s book.

After reading it, I ordered more copies and so far have given this book to five people, four of them under 30-year-olds, because this is something I wish I would’ve read and thought about more when I was young.

The Psychology of Money is divided up into nineteen short chapters, each with a lesson about money, and because they are often counterintuitive, they will make you pause and think. At the end is a brief history of why American consumers think the way they do, which was also somewhat enlightening. Housel’s point of view is that the so-called soft skill of psychology is more important than the technical sides of money.

Here are just some of the things you will learn:

Why nobody is crazy—at least in terms of how they think about and handle money. Remember that p-word in the title…?

About luck, risk, and greed, and how some people really do need to be told that if they spend more money than they have, then they will not end up wealthy.

How amazing compounding really is. This is a hard concept for the human brain to grasp, but Housel explains this too.

Why we can hope to only be pretty reasonable rather than totally rational about money, and that’s okay. We’re human after all.

How you can be wrong half the time and still make a fortune and the difference between getting wealthy and staying wealthy.

Speaking of which…

Housel starts the book with a story about Ronald James Read who fixed cars and worked as a janitor before dying in 2014 at the age of 92.

“So what?” you may ask.

Right. Well the interesting part is that he left an inheritance of $8 million when he died.

Housel also has a great website with loads of articles:

And for a fun 15-minute animated review of the book:

The Swedish Investor’s YouTube video